Why you should have a rosy view of Adelaide’s real estate markets

Billions will be invested in the next decade to capture the potential of SA. JLL managing director and head of capital markets SA Ben Parkinson unpacks the opportunities.

Mar 07, 2024

Last month, for the first time South Australia was nominated by the latest CommSec State of the States report (January 2024) as the state with the best economy in Australia.

South Australia topped the nation in four of the eight key indicators used to measure and rank economic performance among states and territories. We were number one for economic growth, unemployment, construction work and dwelling starts.

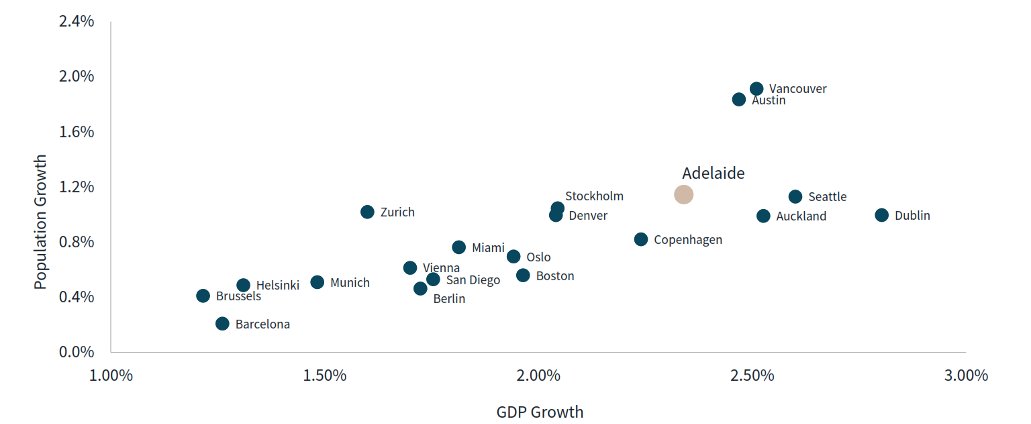

And to ice the cake, Adelaide is one of the top five emerging small cities in the world – with forecast population growth of 1.2 per cent and GDP growth of just under 2.5 per cent (JLL Research, Oxford Economics) – after Vancouver and Austin and ahead of Stockholm and Seattle!

Emerging world cities GDP & population growth, 2023–2033. Source: JLL Research, Oxford Economics

As a side note and to ensure the tourism sector doesn’t miss out, the global travel publisher Lonely Planet ranks Kangaroo Island as the number 2 global destination to visit in 2024.

The CommSec report said that for the first time in the history of its reports, South Australia has taken the lead. South Australia’s population growth rate has more than doubled over the past two years from 0.7 per cent year-on-year to 1.7 per cent year-on-year, showing up in a strong housing market and overall economic activity.

“However, South Australia can’t rest easily. The state will likely face challenges from NSW and Victoria in the period ahead,” Parkinson stated.

What are the manifold opportunities for the commercial real estate market that can be used to stave off competition from the eastern states?

Last week, the head of JLL Research, Andrew Ballantyne, presented a favourable picture of Adelaide’s commercial markets to 2033 and the opportunities presented.

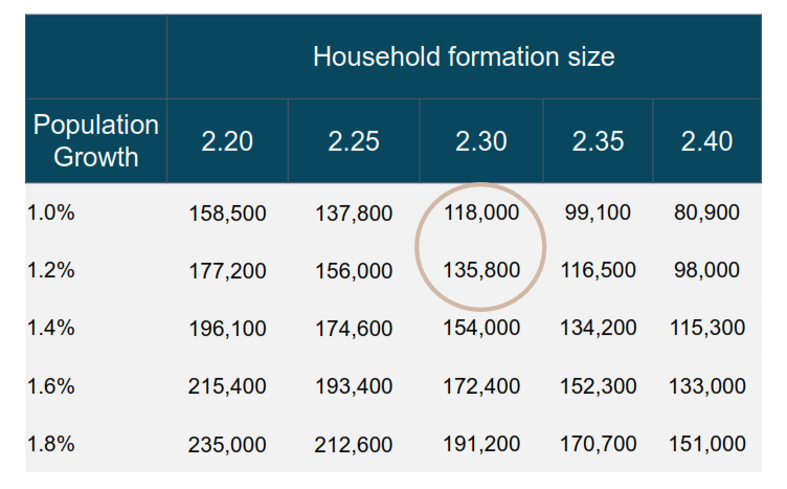

Much of this is based on the strong population growth that could see South Australia’s population reach two million people by 2029, according to the ABS figures. This will require as many as 135,000 new homes at current growth rates.

South Australia dwelling demand, 2023–2033

In addition, over the next ten years, the student population could grow from 45,000 in 2023 to between 53,000 and 72,000 by 2033.

This builds on Adelaide’s education reputation and will require a significant investment in purpose-built student accommodation to ensure we remain an affordable destination for this significant new population.

This is particularly relevant in the context of the now approved university merger and the predicted increase in student enrolment numbers and shortfall in dedicated student accommodation beds.

With the residential vacancy rate consistently under 0.9 per cent in 2023 and no relief in the foreseeable future, we anticipate that one of the ways of dealing with the demand for housing from the population growth is the build-to-rent (BTR) sector.

Based on current velocity from the emerging sector there will be only 715 BTR units constructed by 2033 in Adelaide.

However, with changes and increased participation from developers, there could be as many as 5000 units expected to be completed by 2033.

It is worth noting that the BTR sector had a shot in the arm with the recent development approval of the Sentinel project in Bowden.

The frontline non-residential sector to benefit from population growth will be retailing.

All these new people in Adelaide need to shop – the development of retail floorspace usually lags the population growth, so we expect to see continued development of convenience-based centres in growth areas and consolidation of existing centres as the retail vacancy numbers continue to tighten.

The population growth will also drive the take-up of industrial and logistic space as demand for warehousing grows. Based on JLL research, we will require approximately 4.5 sqm of new industrial space for every new person living in Adelaide.

If we achieve the population growth forecast of 1.4 per cent per annum to 2033, then the Adelaide industrial and logistics sector will require in excess of 1.2 million sqm. This will certainly pose the question as to whether there is enough industrial land supply to meet this forecast demand and why the industrial sector will remain at the forefront of investors mind with rental and land price growth forecast.

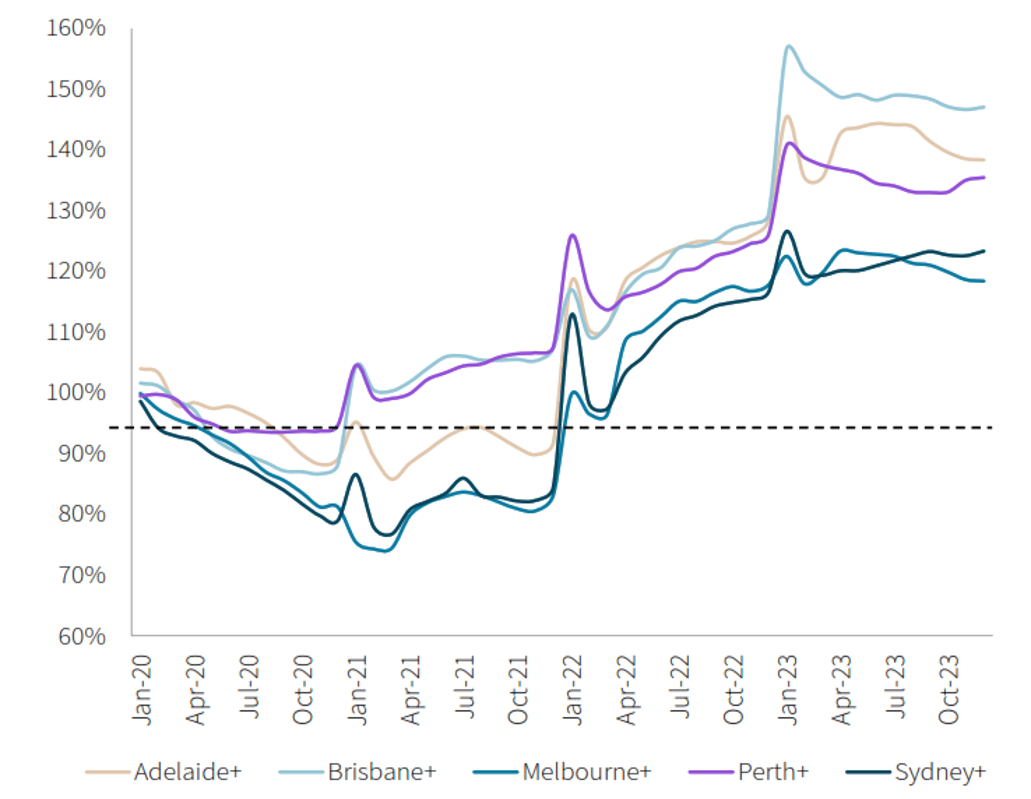

With the expansion and evolution of ‘Mad March’ now spanning 4 months from the Adelaide 500 in December all the way through to the LIV golf extravaganza in April, we have seen hotel room rates rebound to be the second highest in Australia after Brisbane and ahead of Perth, Sydney and Melbourne, and a renewed investor and developer attention with three new hotel projects now approved.

Average daily room rates, 2020–2023. Source: JLL Research, STR

There are also long-term tailwinds for the healthcare sector, based on population growth and the older demographic that Adelaide has by comparison. Using private healthcare as a proxy, private healthcare beds may grow by as much as 2500 by 2040.

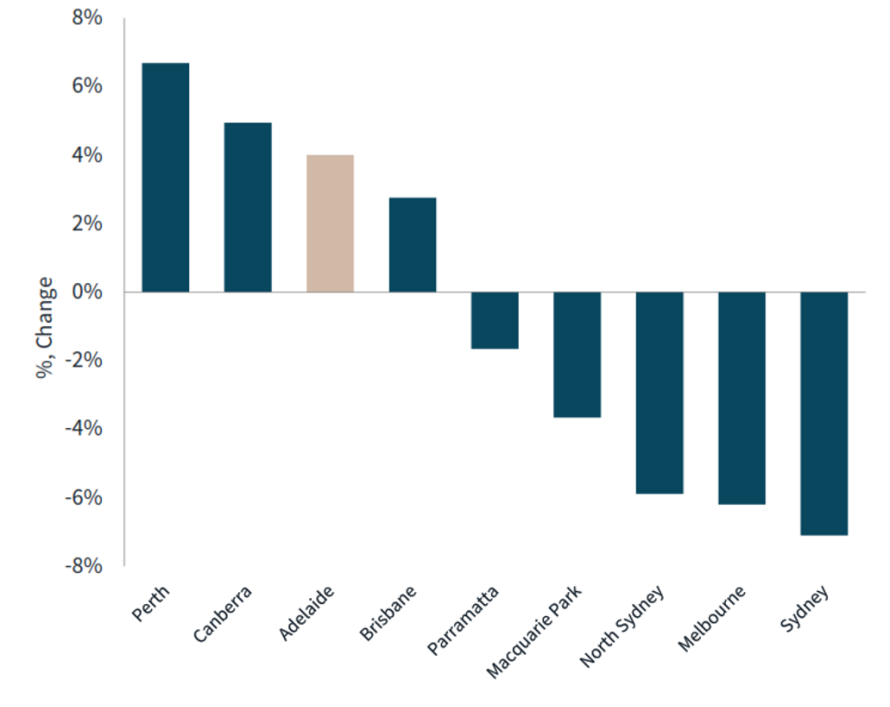

Probably most encouraging from the recent data is that the Adelaide CBD office market is rated as one of Australia’s most resilient, with the change in occupied stock from 2019 to 2023 being positive 4 per cent, which is significantly ahead of Melbourne, Sydney and the other non-core markets of North Sydney, Parramatta and Macquarie Park.

From a global perspective, our office employment outlook to 2033 is second only to Austin and ahead of Auckland and Stockholm.

Office market change in occupied stock, 2019 vs 2023. Source: JLL Research, Oxford Economics

With the improved connections between education and industry, and the focus on talent retention, Adelaide has the opportunity to be transformed in the next decade and truly capitalise on our inherent ‘abilities’ – liveability, affordability and now employability – to realise our true potential.

For over 200 years, JLL has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAY SM. Learn more at jll.com

Original Source In Daily