Values rose across almost 90% of house and unit markets over the year

In today’s Pulse, Economist Kaytlin Ezzy delves into the performance of Australia’s housing market, examining values and rents across our capital markets and regional areas.

Over the past 12 months, CoreLogic’s Home Value Index has risen 8.9%, adding the equivalent of approximately $63,000 to the national median dwelling value ($765,762) and taking the index to a new all-time high in February.

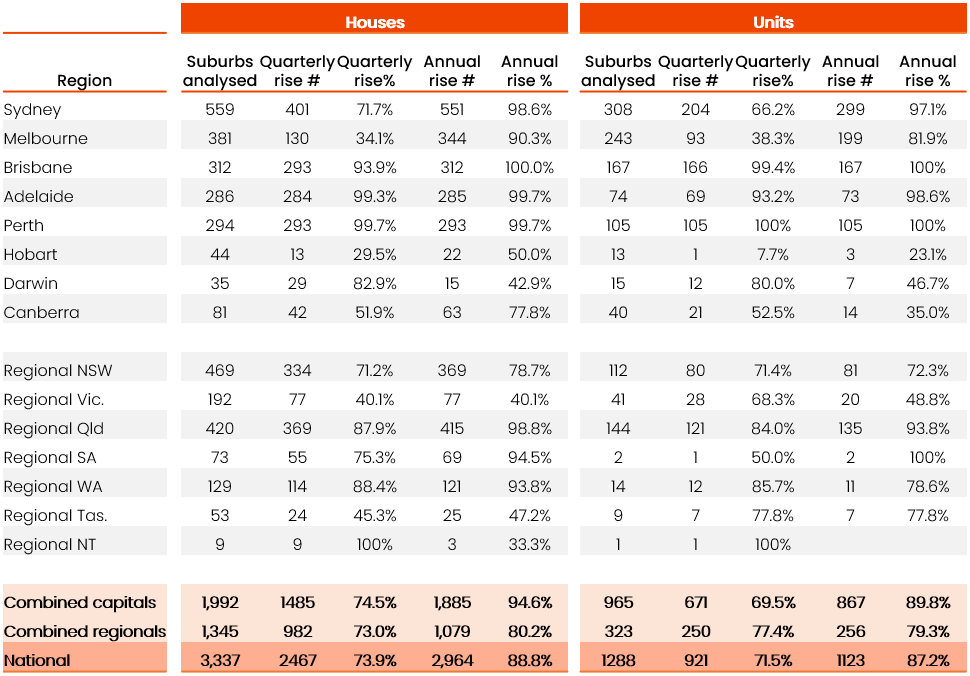

A recent suburb-level analysis using CoreLogic’s interactive Mapping the Market tool found that 88.4% (4,087) of the 4,625 house and unit markets analysed nationally saw values rise over the year. This is up from just 52.9% of markets studied in July 23 (2,456/4,640), recording positive annual growth and up from the 39.1% assessed in February 2023 (1,851/4,732).

CoreLogic Economist Kaytlin Ezzy says the broad-based capital gains seen over the past year reflect the ongoing imbalance between housing supply and demand, which has helped to counteract the less favourable market and affordability conditions.

“Despite three rate hikes, worsening affordability, and the rising cost of living, the increasingly entrenched undersupply in housing stock, and above average demand thanks to strong net migration, has helped push values higher.”

Portion of suburbs recording annual rise in values

Brisbane, Adelaide, and Perth saw the most widespread value uplift year-on-year across both houses and units. All 312 house and 167 unit markets analysed in Brisbane have seen values rise over the year. The inner-city suburb of East Perth (-0.8%) was the only market in the western capital to record a decline in house values, while only one house (Black Forest) and one unit market (Glenelg South) in Adelaide saw values fall over the year to February, down -0.4% and -1.8% respectively. Positive net migration flows, low housing supply and a comparatively low housing prices have all helped support widespread growth across these markets.

“Not only have the annual increases in these cities been fairly broad based, they’ve also been very strong, with the majority of suburbs recording double digit value growth,” says Ms Ezzy.

In Perth, 93.7% (374 out of 399) markets recorded a capital gain of 10% or more over the year, with units in the coastal suburb of Waikiki recording an impressive 42.1% annual rise. Brisbane saw 86.4% of house and unit suburbs rise by more than 10%, with the fastest rising markets clustered around the Brisbane – South and Logan – Beaudesert region, while three quarters of Adelaide markets recorded double digit annual growth.

The same strength is also exhibited in these cities’ quarterly numbers. Houses in Perth’s inner-city suburb of Daglish was the only market to record a decline in values across the city, falling -0.3% over the three months to February. At the other end of the scale, one house market (Kwinana Town Centre) and four unit markets (Dudley Park, Waikiki, Baldivis, Halls Head in Perth’s Mandurah and South West regions) have recorded phenomenal quarterly growth of more than 10%.

“The lion’s share of Adelaide markets also saw values rise over the quarter (99.3% for houses and 93.2% for units), while a few markets in Brisbane’s more expensive inner city region including Hamilton (-5.2%) and Ascot (-2.8%), have seen values fall as affordability and borrowing constants start to weigh more heavily on the market.”

Brisbane’s top-performing markets for quarterly growth were concentrated in the more affordable Logan-Beaudesert, Ipswich, and Moreton Bay regions. Values rose fastest in the city’s most affordable 25% of the market (3.8%), compared to the more expensive upper quartile (2.3%).

Hobart was on the other end of the spectrum, with three out of four markets declining in values over the quarter, while 56.1% recorded values lower than a year ago.

“The weakness in the Hobart market over the past two years contrasts with the positive growth seen from 2017 to 2022. Relatively loose supply levels and negative interstate migration, coupled with the city’s relatively unaffordable price point relative to local incomes, have all likely contributed to falling values over the past two years.”

The quarterly growth rate has also reflected a tentative uptick in growth in more expensive markets like Sydney and Melbourne, which had previously shown some frailty after the November rate hike. Both cities saw their quarterly growth trend improve, from 0.0% in Sydney and -0.9% in Melbourne over the three months to January, to 0.6% and -0.6%, respectively, in February. This resulted in a greater portion of house and unit markets in upswing in both cities. In Sydney, 55.1% of suburbs increased in value over the three months to January, which has lifted to 69.8% in the three months to February. In Melbourne, 33.9% of suburbs rose in value over the three months to January, to which lifted to 35.7% over the three months to February.

Sydney also recorded a broad-based rise in values throughout the year, with just 17 (2%) of the 867 markets analysed recording a decline in value and around half (49.7%) recording value increases above 10%. Stronger value growth in early 2023 saw 87.0% of suburbs in Melbourne record positive annual growth.

“While still relatively board-based, the pace of growth seen across the county’s individual house and unit markets is increasingly diverse – a trend that seems set to continue in 2024.”

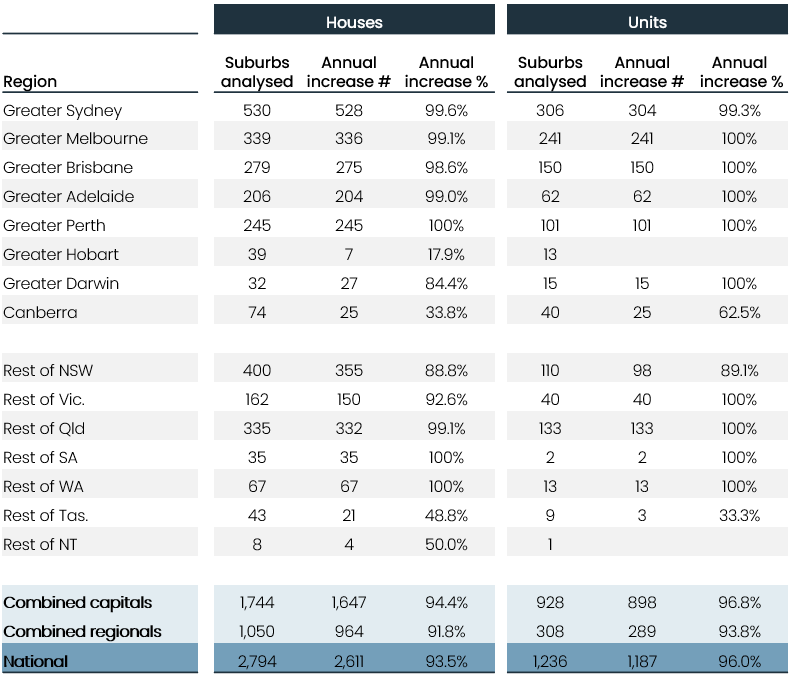

40% of house and unit market record double digit rent rises

The same analysis found that 94.2% of the 4,030 house and unit markets analysed recorded an annual rent rise, while nearly 40% saw rental values rise by 10% or more. After bottoming out in October at 8.1%, the annual trend in national rent values has seen an uptick in recent months, to 8.5% in February, due in part to a recent acceleration in capital city house rents and regional rents.

“Over the past few years, rental growth has been skewed to capital city units, but as unit rent affordability has been eroded, some prospective tenants may be shifting towards house rentals, likely reforming larger households as a way of sharing the rental burden or to more affordable markets further afield.”

Perth was by far the best-performing capital for annual rental growth, with all 245 house and 101 unit markets analysed recording increases over the year, while 85.8% (82.4% for houses and 94.1% for units) saw an annual rent rise of 10% or more. Hobart sat at the opposite end of the scale, with just seven of the 39 house markets analysed seeing a rise in rents, while all 13 of the unit markets analysed saw a decline, ranging from -1.4% (Sorell) to -5.6% (Lenah Valley).

Portion of suburbs recording annual rise in rents

Source: Core Logic Australia