Vendor and buyer activity high, except in Victoria and Tasmania

In today’s Pulse, Tim Lawless analyses the increasing vendor and buyer activity nationwide.

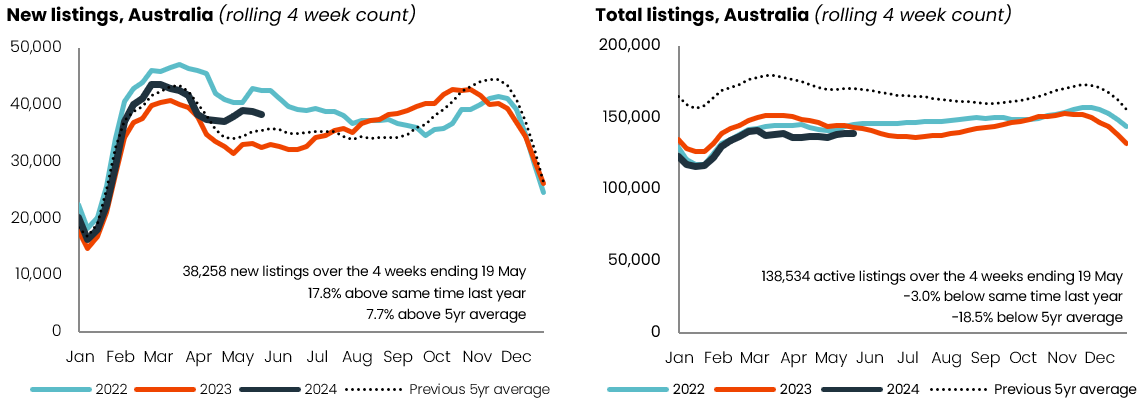

As we approach the cooler winter months the flow of new listings coming to market is slowing, but tracking well above the previous five-year average.

Over the past four weeks CoreLogic tracked 38,258 freshly advertised properties, almost 18% more than at the same time last year and 7.7% above the previous five year average.

The above average level of vendor activity may be tied to the previous dearth of listings as vendors sat on their hands during the early phase of the rate hiking cycle. Or, more home owners could be motivated to sell due to rising levels of financial pressure amid high interest rates and cost of living pressures. Or, some home owners may simply be looking to de-risk their balance sheets by cashing out of the market following a period of significant growth in values.

In reality, the higher level of vendor activity can probably be attributed to a combination of all these factors. In strong markets like Perth, Adelaide and Brisbane, sellers may feel incentivised by market conditions that remain skewed towards vendors, while in softer markets, where overall stock levels are elevated, it is buyers who generally hold the upper hand.

Almost every capital city and rest of state region has seen an increase in vendor activity relative to a year ago, except Hobart (-2.4%) where overall stock levels have been high for several years and values have recorded a substantial downturn since peaking in March 2022.

The other exceptions, but in the opposite direction, are Melbourne (+34.8% on a year ago) and Regional Victoria (+39.4%), which stand out with the largest jump in vendor activity. The larger rise in new listings across Victoria could be related to a combination of factors including high property taxes alongside a rising element of financial stress as high interest rates and cost of living pressures.

Most regions are showing enough buyer demand to absorb the higher than average flow of listings coming to market.

Despite the higher than average trend in new listings, nationally, the total number of homes advertised for sale is holding relatively flat, tracking -3.0% lower than a year ago and almost -19% below the previous five-year average.

However, listings are elevated in some markets.

The total number of advertised properties is sitting above the previous five-year average in Melbourne (+9.6%) and Hobart (+39.3%) as well as Regional Victoria (+29.7%) and Regional Tasmania (+21.9%). Given the higher stock levels and generally soft selling conditions, these regions have generally seen softer value growth.

On the other hand, advertised stock levels remain extremely low in some markets, especially across Western Australia, South Australia and Queensland, where total listings are more than -34% below the previous five-year average. Unsurprisingly, these regions are leading value gains nationally as buyers compete for a small pool of available properties.

Areas of Victoria dominate the top 20 list of SA3 regions

Areas of Victoria dominate the top 20 list of SA3 regions where total listings are most elevated relative to the previous five-year average, taking out the top eight places and comprising 11 of the top 20 overall. Areas of Tasmania were also over-represented in the list, comprising eight of the top 20 areas for the largest lift in listings.

Regional Victoria’s Ballarat has recorded the most substantial lift in listings, with stock levels 31.6% higher than a year ago and more than double the previous five-year average. Stock levels in Ballarat have risen from a low base after moving through record lows during the pandemic, but have been on a persistent upwards trajectory since early 2022, fueling a -11.3% slump in dwelling values from the markets’ peak.

While areas of Regional Victoria dominate the highest rankings for the largest rise in total listings, the outer west and north west of Melbourne have also seen a large rise in advertised stock levels. The SA3’s of Sunbury, Macedon Ranges and Melton-Bacchus Marsh all recorded total listings more than 62% above the previous five-year average. Dwelling values have trended lower in each of these markets, but remain well above pre-pandemic levels.

Outside of Victoria and Tasmania, the only other regions to feature in the top 20 largest increase in total listings were Rouse Hill-McGraths Hill in Sydney and the Snowy Mountains SA3, located in the Capital Region of Regional NSW.

Rural areas of QLD, SA and WA had the most significant listing drops

The most significant drops in total listings relative to the previous five-year average were concentrated in rural areas of Queensland, South Australia and Western Australia. Rural areas of Queensland comprised the top three places on the leagues table and made up eight positions in the overall top 20. In many cases, these areas saw listing numbers fall from extremely high levels leading into the pandemic. The trend towards lower listings in these markets is being fuelled by a combination of housing affordability and the changed demographic patterns that favoured regional markets during the pandemic.

Most of these regions have seen total listings either stabilise around decade lows or continue to trend lower as demand continues to outweigh supply.

The only two capital city SA3 regions to make the top 20 list for the largest decrease in listings were located in Perth (Kwinana) and Brisbane (Beaudesert), with both of these regions offering an extremely affordable median value relative to the broader metro average.

Read Tim Lawless’s full summary in the attached PDF below, which includes a benchmark summary and league tables of:

- The number of new and total listings compared with a year ago and previous five-year average

- Top 20: Largest increase in total listings from previous five-year average (by SA3 region)

- Top 20: Largest decrease in total listings from previous five-year average (by SA3 region)

DOWNLOAD BELOW

https://www.corelogic.com.au/__data/assets/file/0020/22844/240521-CoreLogic-Listings.pdf